Congress's latest coronavirus relief package, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, is the largest economic relief bill in U.S. history and will allocate $2.2 trillion in support to individuals and businesses affected by the pandemic and economic downturn. Many people have questions about how the new law impacts their families and businesses.

Disclaimer: The information in this FAQ may not apply to your specific tax situation. Please direct any tax preparation and filing questions to a professional tax preparer or the Internal Revenue Service (IRS). The Tax Foundation cannot answer specific questions about your tax situation or assist in the tax filing process.

The recovery rebates (Economic Impact Payments) are refundable tax credits. This means that the rebate decreases a taxpayer’s tax liability dollar-for-dollar, and the credit can be refunded to a taxpayer if they have no tax liability to offset.

The rebates are tax credits that will be applied to 2020 tax returns, but are advanced to taxpayers now based on their 2019 or 2018 adjusted gross income (AGI). The credit will be applied to 2020 tax returns using 2020’s AGI next spring, and taxpayers will receive the difference of the credit if it is in their favor.

For example, if a single taxpayer with no children made $200,000 in 2019, they would not receive an advance rebate based on their 2019 income. However, if they make $35,000 in 2020, they will receive a $1,200 refundable tax credit on their 2020 tax return. But in reverse, if a taxpayer had a $35,000 AGI in 2019 but has $200,000 AGI in 2020, they would receive a $1,200 rebate now and would not have to pay it back on their 2020 tax return.

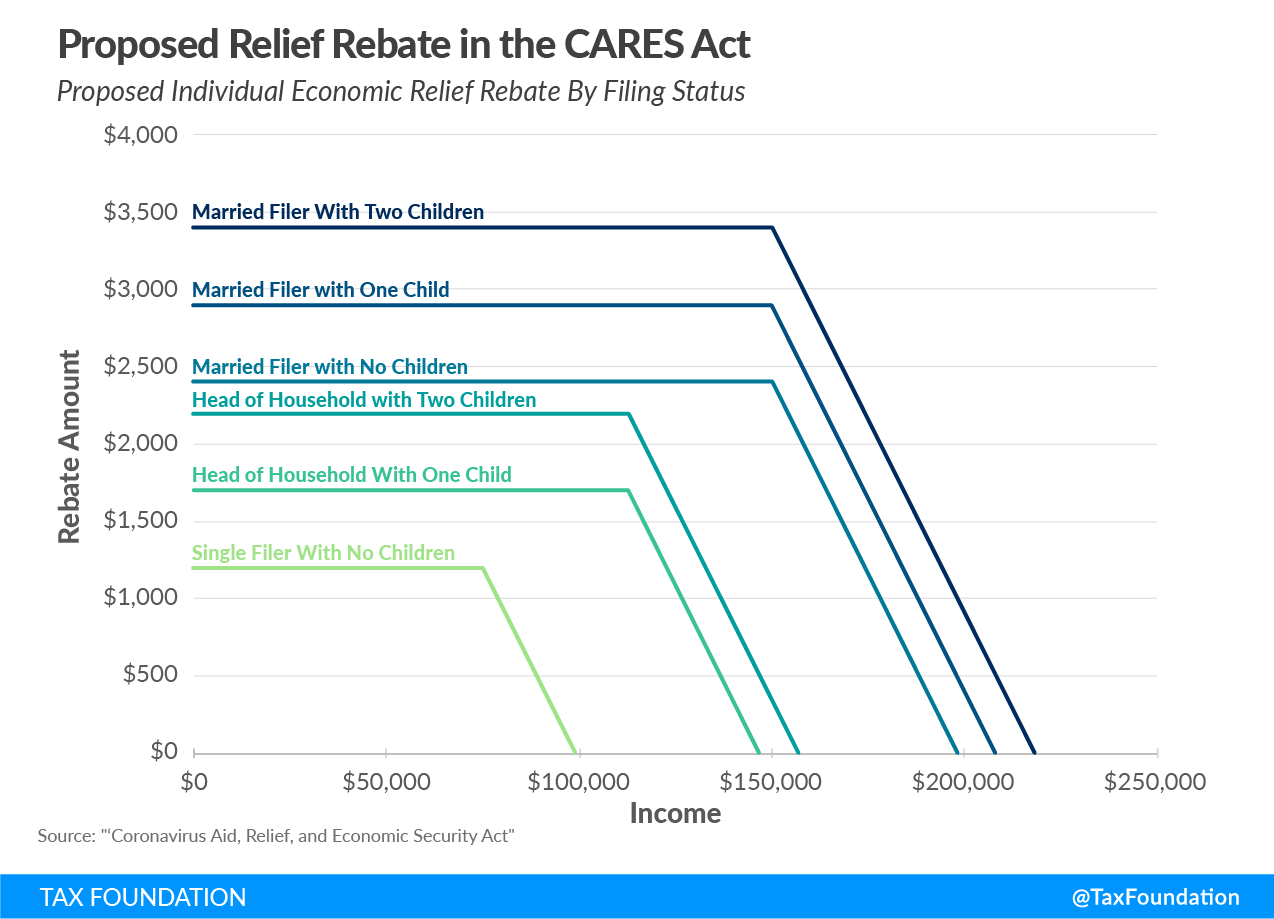

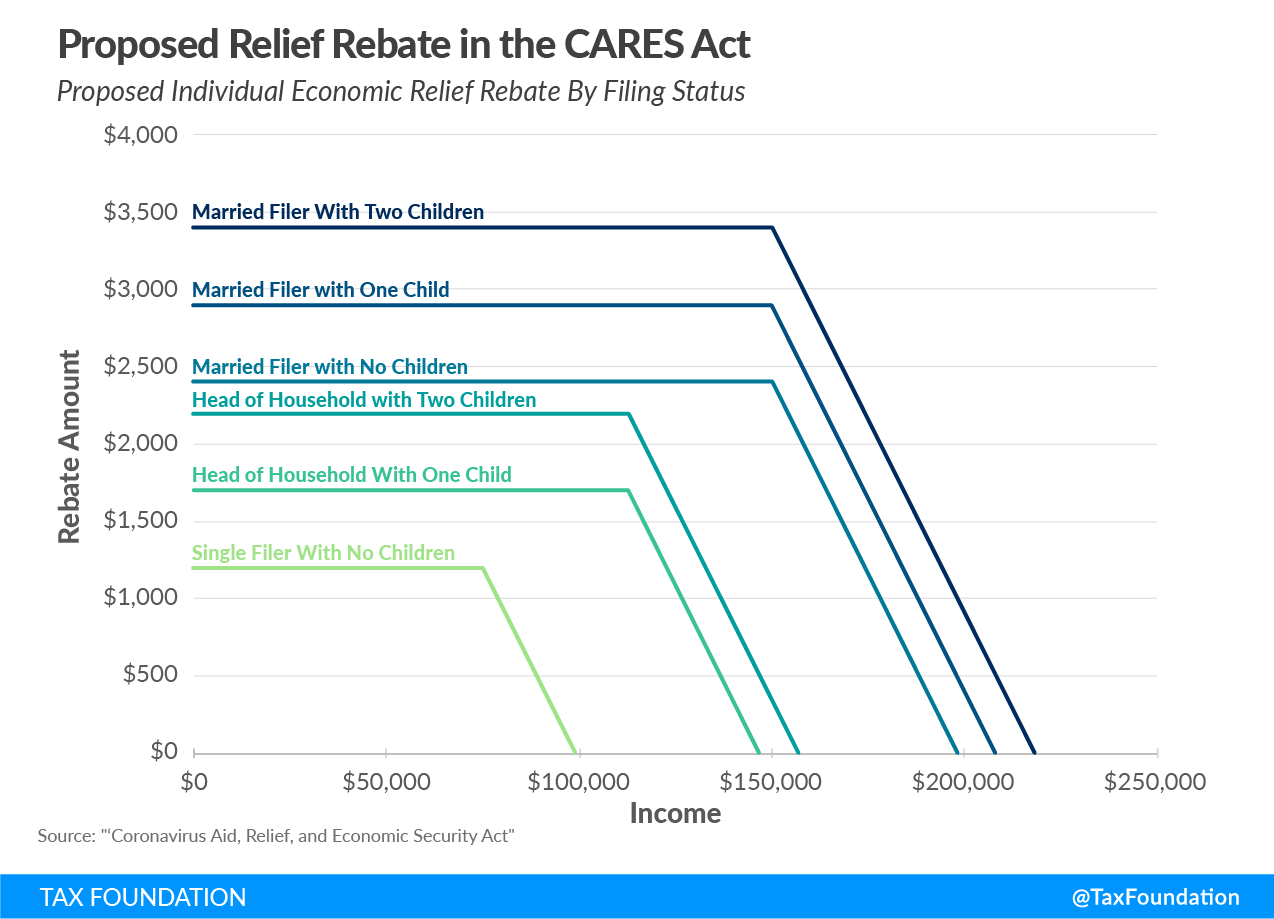

How much of a rebate will I receive?Individuals with a Social Security Number (SSN) and who are not dependents may receive $1,200 (single filers and heads of household) or $2,400 (joint filers), with an additional rebate of $500 per qualifying child, if they have adjusted gross income (AGI) under $75,000 (single), $150,000 (joint), or $112,500 (heads of household) using 2019 tax return information. (The IRS will use 2018 tax return information if the taxpayer has not yet filed for 2019.) The rebate phases out at $50 for every $1,000 of income earned above those thresholds. Use this calculator to determine your rebate using your AGI, number of dependents, and filing status.

For most Americans, no action is required. The IRS will use data from the most current tax returns or Social Security data to provide a rebate to Americans either via direct deposit (if such information is available) or through a paper check in the mail to the last address on file.

U.S. Treasury Secretary Steven Mnuchin said he hopes to distribute rebates to taxpayers who e-filed with direct deposit banking information in three weeks. Taxpayers receiving rebate checks may have to wait six to eight weeks to receive a paper check in the mail.

Treasury will be developing a web-based portal for individuals to provide their banking information to the IRS online. Taxpayers will be able to receive payments immediately as opposed to checks in the mail.

Can I file taxes now for 2019 and have it applied for rebate eligibility?Yes. The IRS has recommended taxpayers to e-file as soon as possible if they think they will be owed a refund and has specifically advised taxpayers not to wait until July 15, the extended deadline from the usual April 15 date.

Are the recovery rebates just an advance on the tax refund I would get anyway when I file my 2020 tax return?

No. The recovery rebates are an additional refundable tax credit that will be applied to 2020 tax returns, but estimates are paid out to taxpayers based on 2019 or 2018 adjusted gross income (AGI). This is an additional credit for the taxpayer on top of whatever refund or tax is owed for the 2020 tax year.

For example, imagine a single taxpayer with no children who made $35,000 AGI in 2019. This taxpayer will receive a $1,200 rebate now, and this rebate would also show up in the taxpayer’s 2020 tax return as a tax credit already received. If the taxpayer would be receiving a $500 tax refund based on their income tax withholding, they would still receive that $500 refund when they file their 2020 tax return.