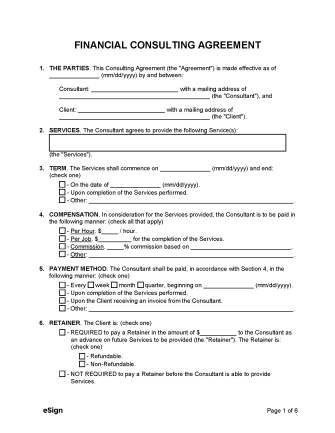

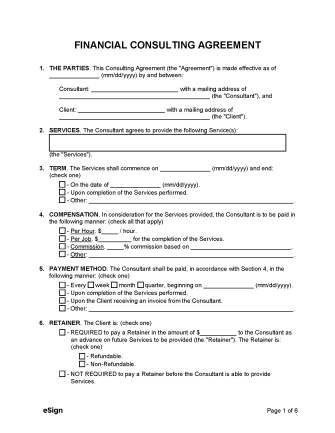

A financial consulting agreement creates a service relationship between a client and a consultant who offers financial advice on a contractual basis. The agreement specifies the consultant’s duties so that each party understands the services to be provided. It also defines compensation terms, including the consultant’s wage, commission rate (if any), and desired payment method.

Long-term service contracts may require the client to pay a retainer fee. In those cases, the agreement will identify the retainer amount and state whether or not the fee is refundable.

A financial consultant is a professional advisor who designs strategies to help clients build wealth and achieve short and long-term financial goals. They typically work for clients externally (i.e., not as an employee) and receive compensation on a per-contract basis.

Higher-level consultants may hold a Chartered Financial Consultant (ChFC) or Certified Financial Planner (CFP) designation, as well as a Series 7 or other professional license issued by the Financial Industry Regulatory Authority (FINRA).

In general, a financial consultant assesses the client’s financial status and offers personalized advice according to their budget, goals, and risk tolerance. What services can and cannot be provided, however, depends on the consultant’s level of certification. Among other things, certified financial consultants typically advise on the following matters:

Financial consultants without proper certification can still help clients organize their finances and build wealth. However, they are not qualified to sell stocks, bonds, mutual funds, or other investment products.

“Financial advisor” and “financial consultant” both refer to a professional who assists others in making informed decisions with their money. While there is no official difference between the two titles, some consulting firms distinguish one from the other based on the worker’s duties and length of time spent with clients.